|

See things from every angle with our fund ratings

How much do you know about the mutual funds you’re choosing?

See things from every angle with our fund ratings

How much do you know about the mutual funds you’re choosing?

Big decisions need careful consideration. That’s why Lipper created a rating system that

looks at funds from every angle – so you can find the investment that fits your goals

Whether you’re looking to preserve capital, reduce expenses or build wealth, our rating

system is designed to help you identify appropriate funds. We’ve identified five key

criteria (or metrics) that measure how successful a fund is at achieving specific goals.

You can use these metrics alone or in combination to create a fund portfolio that’s tailored to your goals.

With the iconic Lipper Ratings you can spend your time more profitably by zeroing in on the funds

that suit you best. You can begin with a single Lipper Leader metric – ‘Consistent Return’ is a

good place to start. This metric identifies funds that provide year-to-year consistency relative

to other funds in their peer group.

As you become more familiar with the Lipper Ratings, you can use more metrics to refine your selection.

You may find it useful to seek assistance from an advisor who can put the metrics in context as well

as help you to identify and prioritize your investment goals.

The Lipper Ratings provides an instant measure of a fund’s success against five

key metrics. Mouse over each of the metrics below to learn more about it then click

on the examples below to view demonstrations of use.

Total Return

Consistent Return

Preservation

Expense

Tax Efficiency

|

The Lipper Leaders metrics

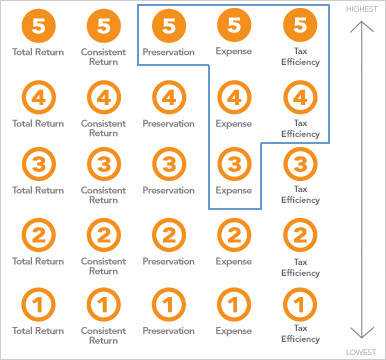

Funds are ranked against their Lipper peer group classifications each month

for 3-, 5-, 10-year, and overall periods. These ratings are based on an equal-weighted

average of percentile ranks of the five Lipper Leaders metrics.

For each metric:

the top 20% of funds receive a rating of ‘5’

and are named Lipper Leaders.

the next 20% of funds receive a rating of ‘4’

the middle 20% of funds receive a rating of ‘3’

the next 20% of funds receive a rating of ‘2’

the lowest 20% of funds receive a rating of ‘1’

Lipper Leaders provide context and perspective for making informed investment decisions

but do not predict future performance.

|

Examples

Maggie’s retirement portfolio

College investment plan for the twins

Lipper Disclaimer

Some peer groups are inherently more volatile than others – a Lipper Leader for Consistent Return in a volatile group may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Total Return reflect fund historic total return performance relative to peers. Lipper Ratings for Consistent Return reflect fund historical risk-adjusted returns relative to peers. Lipper Ratings for Preservation are relative, rather than absolute. Lipper Ratings for Expense reflect fund expense minimization relative to peers. Lipper Ratings for Tax Efficiency (U.S. Only) reflect fund historical ability to postpone taxable distributions. Lipper Ratings DO NOT take into account the effects of sales charges. Overall Ratings are based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable).

Lipper Ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. As a result, you should not make an investment decision on the basis of this information. Rather, you should use Lipper Ratings for informational purposes only. Certain information provided by Lipper may relate to securities that may not be offered sold or delivered within the United States (or any State thereof) or to, or for the account or benefit of, United States persons.

Lipper is not responsible for the accuracy, reliability or completeness of the information that you obtain from Lipper. In addition, Lipper will not be liable for any loss or damage resulting from information obtained from Lipper or any of its affiliates.

|

© 2011 Lipper, a Thomson Reuters Company.

Thomson Reuters/Lipper and the sphere logo are the _trademarks or registered trademarks _of the Thomson Reuters group of companies

_around the world. Published by Thomson Reuters Limited, The Reuters Building, 30 South Colonnade, Canary Wharf, London,

E14 5EP. 10001.01.07

|

See funds from every angle with Lipper Ratings

See funds from every angle with Lipper Ratings

A successful investment strategy matches funds with an individual’s investment goals

and tolerance of risk. In response to this need, Lipper’s Global Research team created

the Lipper Leader Rating System. Lipper Leaders is a mutual fund rating system designed

to deliver a simple, clear description of a fund’s success in meeting certain investment

objectives, such as preserving capital, lowering expenses, or building wealth.

What sets the Lipper Leader Rating System apart is its use of ‘investor-centered’

metrics rather than asset- or style/strategy-based criteria. Lipper Ratings provide

an instant measure of a fund’s success against five key metrics. These metrics can

be used alone or in combination to build individualized portfolios that suit an investor’s particular goals.

Mouse over each of the metrics below to learn more about it.

The Lipper Ratings are derived from highly sophisticated formulas that analyze funds

against a set of clearly defined metrics. Funds are compared to similar funds, and

only those that truly stand out are awarded Lipper Leader status. Each fund is ranked

against its peers based on the metric used (such as Total Return or Expense). Funds

are ranked against their Lipper peer group classifications each month for 3-, 5-,

10-year, and overall periods. These ratings are based on an equal-weighted average

of percentile ranks of the five Lipper Leaders metrics.

For each metric:

the top 20% of funds receive a rating of ‘5’

and are named Lipper Leaders.

the next 20% of funds receive a rating of ‘4’

the middle 20% of funds receive a rating of ‘3’

the next 20% of funds receive a rating of ‘2’

the lowest 20% of funds receive a rating of ‘1’

|

Lipper Leaders provide context and perspective for making informed investment decisions

but do not predict future performance.

Click on the links below to view examples of the Lipper ratings in use.

Examples

Maggie’s retirement portfolio

College investment plan for the twins

Each Lipper Leader metric should be examined in relation to an investor’s goals

to determine its importance when selecting funds for an investment portfolio.

Total return

Place a high premium on past performance? - Important

Believe that past performance has little bearing on the future? - Less important

Consistent return

Emphasis on day-to-day consistency and relative results? - Important

Preference to avoid backward-looking tools? - Less important

Preservation

Need the money from this fund in just a few years? Risk-averse? - Important

Risk-tolerant or investing for a goal that's decades away? - Less important

Tax efficiency

In a high tax bracket and investing in a taxable account? - Important

Investing in a 401(k) or IRA? Low tax bracket? - Less important

Expense

Believe that low-expense funds have a better chance of success? - Important

Feel that investors get what they pay for? - Less important

Once the fund category has been selected and the Lipper Leader metrics to emphasize

are chosen, then a list of suitable funds can be identified. Investors and advisers

can choose an appropriate fund from that list, keeping in mind manager tenure, sales

loads, other fees, and logistical factors such as minimum initial investment.

For additional information about Lipper, please visit www.lipperweb.com

Lipper Disclaimer

Some peer groups are inherently more volatile than others – a Lipper Leader for Consistent Return in a volatile group may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Total Return reflect fund historic total return performance relative to peers. Lipper Ratings for Consistent Return reflect fund historical risk-adjusted returns relative to peers. Lipper Ratings for Preservation are relative, rather than absolute. Lipper Ratings for Expense reflect fund expense minimization relative to peers. Lipper Ratings for Tax Efficiency (U.S. Only) reflect fund historical ability to postpone taxable distributions. Lipper Ratings DO NOT take into account the effects of sales charges. Overall Ratings are based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable).

Lipper Ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. As a result, you should not make an investment decision on the basis of this information. Rather, you should use Lipper Ratings for informational purposes only. Certain information provided by Lipper may relate to securities that may not be offered sold or delivered within the United States (or any State thereof) or to, or for the account or benefit of, United States persons.

Lipper is not responsible for the accuracy, reliability or completeness of the information that you obtain from Lipper. In addition, Lipper will not be liable for any loss or damage resulting from information obtained from Lipper or any of its affiliates.

|

© 2011 Lipper, a Thomson Reuters Company.

Thomson Reuters/Lipper and the sphere logo are the _trademarks or registered trademarks _of the Thomson Reuters group of companies

_around the world. Published by Thomson Reuters Limited, The Reuters Building, 30 South Colonnade, Canary Wharf, London,

E14 5EP. 10001.01.07

|

Capital preservation becomes increasingly important to many investors as they near retirement age. Maggie is a 57 year old advertising executive who plans to retire in 5 years. Maggie earns a reasonably high annual income so she has started to favor investments which offer tax advantages. She recently reviewed her retirement portfolio with her advisor. Together they determined Maggie should adjust her portfolio so the mix of fund investments matched her goals of preserving capital and tax efficiency. Using the Lipper Ratings, they searched for funds rated 5 for Preservation and 4 for Tax Efficiency. Since Maggie prefers to invest in funds with lower expense levels, they also searched for funds rated 3 or better for Expense. Based on these search criteria, Maggie was able to evaluate a narrowed list of suitable funds and chose two that she felt best fit her goals.

Fund A:

Fund A:

Fund B:

Fund B:

College investment plan for the twins

**Examples are for demonstration purposes only. The examples are not exhaustive and do not represent every type of short-, medium-, long-term investment horizon. The strength of the Lipper Leaders is that it can be used with varying degrees of relevance to arrive at a level that suits individual goals.

For more information about Lipper:

College investment plan for the twins

**Examples are for demonstration purposes only. The examples are not exhaustive and do not represent every type of short-, medium-, long-term investment horizon. The strength of the Lipper Leaders is that it can be used with varying degrees of relevance to arrive at a level that suits individual goals.

For more information about Lipper:

Visit our website at www.lipperweb.com

Lipper Disclaimer

Some peer groups are inherently more volatile than others – a Lipper Leader for Consistent Return in a volatile group may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Total Return reflect fund historic total return performance relative to peers. Lipper Ratings for Consistent Return reflect fund historical risk-adjusted returns relative to peers. Lipper Ratings for Preservation are relative, rather than absolute. Lipper Ratings for Expense reflect fund expense minimization relative to peers. Lipper Ratings for Tax Efficiency (U.S. Only) reflect fund historical ability to postpone taxable distributions. Lipper Ratings DO NOT take into account the effects of sales charges. Overall Ratings are based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable).

Lipper Ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. As a result, you should not make an investment decision on the basis of this information. Rather, you should use Lipper Ratings for informational purposes only. Certain information provided by Lipper may relate to securities that may not be offered sold or delivered within the United States (or any State thereof) or to, or for the account or benefit of, United States persons.

Lipper is not responsible for the accuracy, reliability or completeness of the information that you obtain from Lipper. In addition, Lipper will not be liable for any loss or damage resulting from information obtained from Lipper or any of its affiliates.

|

© 2011 Lipper, a Thomson Reuters Company.

Thomson Reuters/Lipper and the sphere logo are the _trademarks or registered trademarks _of the Thomson Reuters group of companies

_around the world. Published by Thomson Reuters Limited, The Reuters Building, 30 South Colonnade, Canary Wharf, London,

E14 5EP. 10001.01.07

|

Many long-term investors tend to focus on total and/or consistent returns. Rachel and Todd are brand new parents of twin girls. They are both in their late 20’s and they are both employed full-time. In addition to saving for retirement, they’re now starting a college investment plan for the children. They intend to contribute monthly to the college investment plan for a period of 18 years or longer. They would like to achieve consistent growth while balancing risk. Using the Lipper Ratings, Rachel and Todd searched for funds rated 5 for Total Return and rated 5 for Consistent Return. In addition, they searched for funds with an Expense rating of 3 or better to find funds offering lower management fees. Based on these search criteria, Rachel and Todd evaluated the narrowed list of suitable funds and identified four they felt best fit their objectives.

Fund A:

Fund B:

Maggie’s retirement portfolio

**Examples are for demonstration purposes only. The examples are not exhaustive and do not represent every type of short-, medium-, long-term investment horizon. The strength of the Lipper Leaders is that it can be used with varying degrees of relevance to arrive at a level that suits individual goals.

For more information about Lipper:

Visit our website at www.lipperweb.com

Lipper Disclaimer

Some peer groups are inherently more volatile than others – a Lipper Leader for Consistent Return in a volatile group may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Total Return reflect fund historic total return performance relative to peers. Lipper Ratings for Consistent Return reflect fund historical risk-adjusted returns relative to peers. Lipper Ratings for Preservation are relative, rather than absolute. Lipper Ratings for Expense reflect fund expense minimization relative to peers. Lipper Ratings for Tax Efficiency (U.S. Only) reflect fund historical ability to postpone taxable distributions. Lipper Ratings DO NOT take into account the effects of sales charges. Overall Ratings are based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable).

Lipper Ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. As a result, you should not make an investment decision on the basis of this information. Rather, you should use Lipper Ratings for informational purposes only. Certain information provided by Lipper may relate to securities that may not be offered sold or delivered within the United States (or any State thereof) or to, or for the account or benefit of, United States persons.

Lipper is not responsible for the accuracy, reliability or completeness of the information that you obtain from Lipper. In addition, Lipper will not be liable for any loss or damage resulting from information obtained from Lipper or any of its affiliates.

|

© 2011 Lipper, a Thomson Reuters Company.

Thomson Reuters/Lipper and the sphere logo are the _trademarks or registered trademarks _of the Thomson Reuters group of companies

_around the world. Published by Thomson Reuters Limited, The Reuters Building, 30 South Colonnade, Canary Wharf, London,

E14 5EP. 10001.01.07

|

|

|

|

|

|